The cost of a routine medical examination without insurance coverage can vary significantly based on several factors, including geographic location, the specific services included, and the clinic or healthcare provider chosen. A basic exam might involve checking vital signs, reviewing medical history, and a brief physical assessment. More comprehensive checkups could include additional screenings, laboratory tests, or specialized procedures, each contributing to the overall expense.

Regular health assessments are vital for preventative care, allowing for early detection of potential health issues and timely intervention. These examinations can lead to better health outcomes and potentially reduce long-term healthcare costs by addressing problems before they become severe. While the expense can be a barrier for the uninsured, numerous resources exist to help manage these costs, such as community health clinics and sliding-scale fee structures offered by some providers. Understanding the available options can empower individuals to prioritize their health and well-being.

The following sections will explore the typical cost ranges for routine medical exams without insurance, detail the factors influencing price variations, and outline strategies for accessing affordable healthcare services. Additional resources and tools for navigating the healthcare system without insurance will also be provided.

Tips for Managing the Cost of Routine Medical Exams Without Insurance

Navigating healthcare expenses without insurance can be challenging. The following tips offer strategies for obtaining necessary medical checkups while managing costs effectively.

Tip 1: Research Community Health Clinics: Federally Qualified Health Centers (FQHCs) offer comprehensive medical services on a sliding-fee scale based on income. These clinics provide affordable options for essential checkups and preventative care.

Tip 2: Inquire About Discounted Cash Prices: Many healthcare providers offer reduced rates for patients who pay upfront in cash. Contact clinics directly to inquire about potential discounts for routine checkups.

Tip 3: Explore Negotiated Rates Through Healthcare Marketplaces: Even without purchasing insurance, some healthcare marketplaces offer resources for finding providers with negotiated rates for specific services, including routine exams.

Tip 4: Consider Direct Primary Care (DPC): DPC practices offer membership-based primary care services for a fixed monthly fee. This fee often includes routine checkups and other basic medical services, providing predictable healthcare costs.

Tip 5: Utilize Free or Low-Cost Preventive Screenings: Certain preventative screenings, such as blood pressure checks and cholesterol screenings, are sometimes offered for free or at low cost through community health initiatives and local organizations. Research available programs in the local area.

Tip 6: Compare Prices from Different Providers: Contact multiple clinics and hospitals to compare prices for routine checkups. Transparency in pricing can help individuals find the most affordable option.

Tip 7: Plan for Healthcare Expenses: Budgeting and setting aside funds specifically for healthcare can make routine checkups more manageable. Even small, regular contributions can help offset the cost of essential medical services.

By implementing these strategies, individuals can access essential medical checkups without insurance while mitigating financial burdens. Prioritizing preventative care contributes to long-term health and well-being.

The information presented here aims to provide practical guidance for navigating the healthcare system without insurance. Consulting with healthcare professionals and local resources can offer further personalized advice.

1. Clinic Type

Clinic type significantly influences the cost of medical examinations for uninsured individuals. Options range from private practices and urgent care centers to community health clinics and free clinics. Each operates under different financial models, resulting in substantial price variations for similar services. Private practices, often focused on specialized care, tend to have higher overhead costs, which are reflected in their pricing structure. Urgent care centers, designed for immediate but non-life-threatening medical needs, generally fall in a mid-range price category. Conversely, community health clinics, frequently supported by government subsidies and grants, offer services on a sliding-fee scale based on income, making healthcare more accessible for low-income individuals. Free clinics, often staffed by volunteers and relying on donations, provide care at no cost to patients, but availability may be limited.

For example, a routine physical examination at a private practice might cost several hundred dollars without insurance, while a comparable checkup at a community health clinic could cost significantly less, potentially a fraction of the price. Choosing a free clinic, if available and suitable for the individual’s needs, eliminates the cost entirely. Therefore, understanding the nuances of different clinic types is crucial for uninsured individuals seeking cost-effective healthcare. Selecting the appropriate clinic type based on individual financial circumstances and healthcare needs can significantly impact overall expenses.

Careful consideration of clinic type empowers informed decision-making regarding healthcare access and cost management. While private practices offer specialized expertise and potentially shorter wait times, the associated higher costs might be prohibitive for uninsured individuals. Exploring community health clinics and free clinics, while potentially involving longer wait times or limited service availability, offers substantial cost savings. Balancing these factors requires careful assessment of individual circumstances and priorities.

2. Geographic Location

Geographic location plays a significant role in determining the cost of healthcare services, including routine physical checkups for uninsured individuals. Variations in cost of living, market competition, and regional healthcare infrastructure all contribute to price disparities across different geographic areas. Understanding these geographic influences is essential for informed decision-making regarding healthcare access and cost management.

- Cost of Living

Areas with a higher cost of living generally experience higher healthcare costs. This includes routine services like physical checkups. Factors such as rent, utilities, and salaries for medical professionals contribute to elevated prices in these regions. For example, a routine checkup in a major metropolitan area with a high cost of living might be significantly more expensive than in a smaller, rural town.

- Market Competition

The level of competition among healthcare providers within a specific region can influence pricing. Areas with a higher concentration of clinics and hospitals may offer more competitive pricing for services like routine checkups, driving down costs for uninsured patients. Conversely, regions with limited healthcare options may experience higher prices due to decreased competition.

- Healthcare Infrastructure

The availability of advanced medical facilities and specialized services can affect overall healthcare costs in a region. Areas with a greater concentration of specialized hospitals and research centers may experience higher prices for even basic services like checkups, due in part to the higher overhead costs associated with maintaining such facilities.

- State Regulations

State-specific regulations and healthcare policies can also influence pricing. Some states may have regulations that impact healthcare costs, potentially affecting the price of routine checkups for uninsured individuals. These regulations can vary significantly from state to state, leading to regional disparities in pricing.

These interconnected factors underscore the importance of considering geographic location when evaluating the cost of routine medical checkups without insurance. Researching local healthcare options, comparing prices from different providers within a region, and understanding regional cost-of-living variations can help individuals navigate healthcare expenses effectively. Ultimately, recognizing the influence of geographic location empowers uninsured individuals to make informed choices about their healthcare and manage costs strategically.

3. Services Included

The specific services included in a physical checkup directly impact the overall cost for uninsured individuals. A basic checkup focusing on vital signs, medical history review, and a brief physical examination will typically be less expensive than a more comprehensive examination. Adding services such as laboratory tests (e.g., blood work, urinalysis), diagnostic imaging (e.g., X-rays, ultrasounds), or specialized screenings (e.g., EKG, vision tests) increases the total expense. The cumulative effect of these additional services can significantly influence the final cost, making it essential for individuals to understand precisely what services are included in a quoted price. For example, a checkup including a lipid panel and complete blood count will invariably cost more than a checkup limited to vital signs and physical examination.

Understanding the relationship between services included and cost allows individuals to tailor their checkups to their specific needs and budget. If cost is a primary concern, opting for a basic checkup and deferring non-essential tests or screenings to a later date can be a viable strategy. Conversely, individuals with specific health concerns or risk factors might prioritize a more comprehensive evaluation, accepting the associated higher cost. For instance, someone with a family history of heart disease might opt for a checkup including an EKG, even if it adds to the expense, while a healthy young adult might choose a more basic checkup. Negotiating with healthcare providers about the necessity of specific services and exploring alternative, lower-cost options for certain tests can further contribute to cost management.

Effectively managing the cost of a physical checkup without insurance requires a clear understanding of the services offered and their associated expenses. Open communication with healthcare providers about individual health needs and budgetary constraints can facilitate informed decision-making regarding which services to include. Prioritizing essential services, exploring lower-cost alternatives, and phasing procedures over time can empower uninsured individuals to access necessary healthcare while mitigating financial strain. Ultimately, aligning services received with individual health needs and budgetary limitations ensures cost-effective and appropriate healthcare utilization.

4. Doctor's Specialty

A physician’s specialization directly influences the cost of a physical checkup without insurance. General practitioners typically charge less for routine physicals compared to specialists like cardiologists or dermatologists. This difference stems from specialists’ advanced training and expertise in specific medical areas, often reflected in higher fees. For instance, a routine physical with a general practitioner might cost significantly less than a physical performed by a cardiologist, even if the basic components of the examination are similar. Choosing a general practitioner for a routine checkup can be a cost-effective strategy for uninsured individuals, reserving specialist visits for specific health concerns or referrals.

While seeing a specialist directly for a routine physical might offer the advantage of immediate access to specialized expertise, the associated higher cost can be a significant barrier for uninsured individuals. Unless a specific medical condition necessitates specialist care, opting for a general practitioner for routine physicals and seeking specialist referrals only when necessary can be a more financially prudent approach. This strategy allows individuals to access preventative care while managing costs effectively. For example, an individual with no known heart conditions could have a routine physical with a general practitioner, while someone with a history of heart problems might benefit from seeing a cardiologist directly, despite the higher cost.

Understanding the connection between doctor specialty and cost empowers informed decision-making regarding healthcare utilization for uninsured individuals. Prioritizing cost-effectiveness by utilizing general practitioners for routine care and seeking specialist referrals only when medically necessary can help manage healthcare expenses without compromising essential preventative services. This approach recognizes the value of specialist expertise while acknowledging the financial realities of navigating the healthcare system without insurance. Prudent utilization of specialist services based on individual health needs ensures both effective healthcare management and cost containment.

5. Additional Tests

The cost of a physical checkup without insurance is significantly affected by the inclusion of additional tests beyond the basic examination. These tests, while often valuable for comprehensive health assessments, contribute directly to the overall expense. Understanding the types of additional tests typically offered during a physical and their associated costs allows for informed decision-making regarding which tests are necessary and financially feasible.

- Laboratory Tests

Laboratory tests, such as blood work and urinalysis, provide crucial insights into organ function, detect potential infections, and assess overall health status. A complete blood count (CBC) can reveal information about red and white blood cells and platelets, while a comprehensive metabolic panel (CMP) assesses kidney and liver function, electrolyte balance, and blood glucose levels. These tests add to the overall cost of the checkup. For example, a lipid panel to check cholesterol levels might add $50-$100 to the total bill, while a more extensive blood test panel could add significantly more.

- Diagnostic Imaging

Diagnostic imaging procedures, such as X-rays and ultrasounds, offer visual representations of internal organs and structures. These tests can be crucial for identifying specific conditions or abnormalities. A chest X-ray, for instance, can help diagnose pneumonia or other lung conditions, while an abdominal ultrasound might be used to evaluate organ size and identify potential masses. The cost of these procedures can vary depending on the complexity and type of imaging. An X-ray might cost $50-$200, while an ultrasound could range from $100-$500 or more.

- Electrocardiogram (EKG)

An EKG records the electrical activity of the heart, providing valuable information about heart rhythm and function. This test is often recommended for individuals with a family history of heart disease or those experiencing symptoms such as chest pain or palpitations. The cost of an EKG can range from $50-$200 depending on the facility.

- Other Specialized Screenings

Additional screenings, like vision and hearing tests, can also be incorporated into a physical checkup. While contributing to preventative care, these screenings add to the overall expense. Vision tests can detect refractive errors and other eye conditions, while hearing tests assess auditory function. Costs for these screenings can vary, with vision tests typically ranging from $50-$150 and hearing tests from $50-$200.

The decision to include additional tests during a physical checkup without insurance requires careful consideration of individual health needs, risk factors, and budgetary constraints. Discussing the necessity and cost of each test with a healthcare provider allows for informed decisions aligned with both health priorities and financial realities. Opting for a phased approach, where essential tests are prioritized initially and additional tests are considered later, can help manage costs effectively while ensuring comprehensive preventative care over time. Ultimately, a balanced approach to additional testing empowers uninsured individuals to access necessary healthcare services while navigating financial limitations.

6. Payment Options

Payment options significantly influence the overall cost and accessibility of routine physical checkups for individuals without insurance. Understanding the various payment methods available and their implications is crucial for managing healthcare expenses and ensuring access to necessary preventative care. Negotiating payment terms and exploring available resources can significantly impact the final cost of a checkup.

- Cash Payments

Paying in cash upfront can often lead to discounted rates at some healthcare facilities. Many clinics offer reduced prices for patients who pay in full at the time of service. This option can be particularly advantageous for routine checkups, providing immediate cost savings. Inquiring about cash discounts when scheduling an appointment can reveal potential cost reductions.

- Payment Plans

Some healthcare providers offer payment plans, allowing patients to spread the cost of a checkup over several installments. This approach makes healthcare more manageable for individuals facing financial constraints, enabling them to access necessary services without incurring immediate, substantial expenses. Negotiating a payment plan with the clinic’s billing department can establish a manageable payment schedule.

- Medical Credit Cards

Medical credit cards are specifically designed for healthcare expenses, offering financing options for medical procedures and services. These cards can provide a way to pay for a checkup over time, often with promotional interest rates or deferred payment options. However, careful consideration of interest rates and terms is crucial to avoid accumulating excessive debt. Comparing different medical credit card offers and understanding their terms and conditions is essential before applying.

- Negotiated Rates Through Healthcare Marketplaces

Even without purchasing insurance, exploring healthcare marketplaces can sometimes reveal providers offering negotiated rates for specific services, including routine checkups. These marketplaces can provide a resource for finding discounted healthcare options within a specific geographic area. Utilizing these platforms to compare prices and services can lead to cost savings.

Navigating the cost of healthcare without insurance requires a proactive approach to payment options. Understanding the available methods, negotiating payment terms, and researching potential discounts or resources empower individuals to manage expenses effectively while prioritizing essential preventative care. Choosing the most suitable payment option based on individual financial circumstances ensures access to necessary healthcare services while minimizing financial strain. Ultimately, informed decision-making regarding payment options contributes to both cost-effective healthcare utilization and overall financial well-being.

Frequently Asked Questions

This section addresses common inquiries regarding the cost and accessibility of routine medical checkups for individuals without health insurance coverage.

Question 1: What is the average cost of a routine physical checkup without insurance?

The cost varies significantly depending on factors like location, clinic type, and services included, ranging from $50 to $300 or more for a basic exam. Additional tests and services increase the overall expense.

Question 2: Are there free or low-cost options for medical checkups without insurance?

Community health centers and free clinics offer services on a sliding-fee scale or at no cost, making healthcare more accessible for low-income individuals. Availability may vary depending on location and resources.

Question 3: How can one find affordable medical checkups without insurance?

Researching local community health centers, inquiring about discounted cash prices at various clinics, and exploring negotiated rates through healthcare marketplaces can help individuals find affordable options.

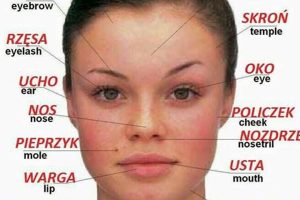

Question 4: What are the essential components of a routine physical checkup?

A basic checkup typically includes vital signs measurement, medical history review, and a brief physical examination. Additional tests, such as blood work or diagnostic imaging, may be recommended based on individual health needs and risk factors.

Question 5: How often should one get a routine physical checkup without insurance?

While individual needs vary, an annual checkup is generally recommended for preventative care and early detection of potential health issues. More frequent checkups may be necessary for individuals with specific health conditions or risk factors.

Question 6: Can routine medical checkups help manage long-term healthcare costs?

Preventative care through routine checkups can lead to early detection and treatment of health problems, potentially preventing more serious and costly medical issues down the line.

Managing healthcare costs without insurance necessitates informed decision-making and proactive exploration of available resources. Understanding cost variations, available payment options, and accessible healthcare services empowers individuals to prioritize their health and well-being.

For further information and personalized guidance, consult with local healthcare professionals and community resources.

Cost of a Physical Checkup Without Insurance

Navigating the healthcare landscape without insurance can be complex, especially when considering the cost of essential services like routine physical checkups. This exploration has highlighted the multifaceted nature of this issue, emphasizing the influence of factors such as geographic location, clinic type, services included, doctor specialization, and payment options on the overall expense. Community health clinics, sliding-scale fees, and negotiated rates through healthcare marketplaces offer potential avenues for affordable healthcare access. Understanding these resources and employing strategic cost management techniques, such as prioritizing essential services and negotiating payment plans, can help individuals access necessary preventative care while mitigating financial strain.

Proactive engagement with the healthcare system, even without insurance, remains crucial for long-term health and well-being. Informed decision-making regarding healthcare utilization, combined with diligent exploration of available resources, empowers individuals to prioritize preventative care and manage healthcare costs effectively. Access to routine medical checkups, regardless of insurance status, represents a critical component of individual and community health, underscoring the importance of continued efforts to enhance healthcare affordability and accessibility.