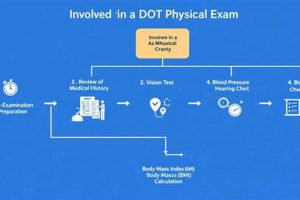

Department of Transportation (DOT) physical examinations are medical assessments required for individuals operating commercial motor vehicles (CMVs). These examinations ensure drivers meet specific health standards to safely operate these vehicles, protecting both themselves and the public. A typical examination includes checks of vision, hearing, blood pressure, and overall physical condition. For example, a truck driver transporting goods across state lines would be required to undergo this type of medical evaluation.

These mandated health checks play a critical role in maintaining roadway safety. By verifying drivers are physically capable of handling the demands of commercial driving, the examinations contribute to reducing the risk of accidents. This practice has a long history, evolving alongside the trucking industry to address increasing safety concerns related to interstate commerce and the operation of large vehicles. Early regulations paved the way for the more comprehensive system in place today.

This article will further explore the regulatory framework surrounding these medical evaluations, discuss common reasons for disqualification, and delve into other crucial information related to CMV operator health and safety.

Successfully meeting medical certification standards for commercial driving requires preparation and understanding of the regulations. The following tips offer valuable guidance for prospective and current CMV operators.

Tip 1: Maintain a Healthy Lifestyle. Consistent healthy habits, including regular exercise, a balanced diet, and adequate sleep, contribute significantly to meeting the physical requirements. For example, managing weight and blood pressure through lifestyle choices can prevent potential disqualification.

Tip 2: Schedule Examinations Proactively. Do not wait until the last minute. Scheduling appointments in advance allows ample time to address any potential health concerns that might arise during the examination.

Tip 3: Disclose All Medical Conditions. Complete honesty with the medical examiner is crucial. Withholding information, even seemingly minor details, can lead to disqualification and potential safety risks.

Tip 4: Understand Vision Requirements. Be aware of the specific vision standards, including requirements for visual acuity, field of vision, and corrective lenses. Consult an eye specialist prior to the examination if vision concerns exist.

Tip 5: Keep Accurate Medical Records. Maintain organized documentation of medical history, diagnoses, treatments, and medications. This facilitates the examination process and provides valuable information to the medical examiner.

Tip 6: Follow Prescribed Treatments. Adherence to prescribed medications and treatment plans for existing conditions is essential for demonstrating medical stability and compliance with regulations.

Tip 7: Seek Clarification When Needed. If any aspect of the medical requirements is unclear, consult with a qualified medical professional specializing in DOT physicals or contact the relevant regulatory agency for clarification.

By following these recommendations, prospective and current commercial drivers can improve their chances of successfully meeting medical certification requirements and contribute to maintaining a safe transportation environment.

These proactive strategies empower drivers to navigate the medical certification process effectively and uphold the highest standards of safety on the road. This commitment to driver health and wellness underscores the importance of responsible commercial vehicle operation.

1. Employer Coverage

Employer coverage plays a significant role in determining whether DOT physicals are covered by insurance. For many commercial drivers, employer-sponsored health plans represent the primary avenue for covering the cost of these mandatory examinations. Understanding the nuances of employer coverage is therefore crucial for both employers and employees.

- Full Coverage Policies

Some employers offer comprehensive health plans that fully cover the cost of DOT physicals. This approach recognizes the importance of these examinations for employee safety and compliance with regulations. For instance, a large trucking company might integrate DOT physicals into its preventative health program, absorbing the full cost as a business expense.

- Partial Coverage or Reimbursement

Other employers may offer partial coverage or reimbursement for DOT physical expenses. This can involve a fixed amount or a percentage of the total cost. In such cases, employees would be responsible for the remaining portion of the expense. For example, an employer might reimburse up to a specific dollar amount, leaving the employee to cover any excess costs.

- Contingent Coverage

In certain situations, coverage might be contingent on factors such as successful completion of the physical or the driver’s role within the company. For example, an employer might only cover the cost if the driver passes the physical and is subsequently employed. Alternatively, coverage might only be extended to drivers operating specific types of commercial vehicles.

- Absence of Coverage

Some employers, particularly smaller companies or independent contractors, may not offer any coverage for DOT physicals. This leaves the driver responsible for the full cost of the examination. In these situations, drivers need to explore alternative options, such as personal insurance, HSAs, or negotiated rates with clinics.

The variability in employer coverage underscores the importance of clear communication between employers and employees regarding DOT physical expenses. Prospective employees should inquire about coverage details during the hiring process, while current employees should review their health plan documents to understand their financial responsibilities related to these mandatory examinations. This awareness allows drivers to budget accordingly and ensures compliance with regulatory requirements without undue financial burden.

2. Personal Insurance Policies

Personal insurance policies represent a potential avenue for covering the cost of DOT physicals, particularly for owner-operators or drivers whose employers do not provide coverage. However, coverage under personal health insurance plans is not guaranteed and varies significantly based on the specific policy. Several factors influence whether a personal policy will cover these examinations.

Policy Type and Coverage Details: The specific type of personal health insurance policy plays a crucial role. HMOs, PPOs, and other plan types have different coverage structures, and some may explicitly exclude preventative or occupational health services. Examining policy documents carefully is essential to understanding the extent of coverage. Some policies might categorize DOT physicals as preventative care, subject to specific cost-sharing provisions like co-pays or deductibles. Other policies might consider them occupational health services, potentially excluding them from coverage altogether. For example, a driver with an HMO might find the physical covered under preventative care, while a driver with a PPO that excludes occupational health might need to cover the entire cost.

Specific Exclusions and Limitations: Even if a policy generally covers preventative or occupational health services, specific exclusions or limitations might apply to DOT physicals. Some policies might limit the frequency of covered physicals or impose specific requirements for the examining physician. Understanding these limitations is crucial to avoid unexpected out-of-pocket expenses. A policy might, for instance, only cover one physical every two years or require the examination to be performed by a physician within the insurer’s network. Drivers must carefully review their policy documents for such stipulations.

Pre-Authorization Requirements: Some insurers might require pre-authorization for DOT physicals. Failing to obtain pre-authorization could result in denial of coverage. Contacting the insurance company prior to the examination is essential to confirm pre-authorization requirements and ensure a smooth claims process. Without pre-authorization, the driver might be responsible for the full cost, even if the physical would typically be covered under the policy.

Navigating the complexities of personal insurance coverage for DOT physicals requires careful consideration of policy specifics. Reviewing policy documents, contacting the insurance provider for clarification, and exploring alternative coverage options like HSAs or negotiated rates can help drivers manage the financial aspects of meeting these essential regulatory requirements.

3. Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer a potential resource for covering the cost of DOT physicals, providing a tax-advantaged way to save and pay for qualified medical expenses. Understanding the relationship between HSAs and DOT physicals requires careful consideration of eligibility requirements and eligible expenses.

- HSA Eligibility Requirements

HSA eligibility is contingent on enrollment in a high-deductible health plan (HDHP). Individuals covered by other types of health insurance, including Medicare, are generally not eligible to contribute to an HSA. Furthermore, an individual cannot be claimed as a dependent on someone else’s tax return. This restricts HSA availability for some drivers, particularly those covered by employer-sponsored traditional health plans or government-sponsored programs.

- Qualified Medical Expenses

HSAs can be used to pay for a range of qualified medical expenses, including doctor visits, prescription medications, and preventative care. DOT physicals generally qualify as a preventative care expense, making them eligible for HSA reimbursement. However, it’s crucial to confirm that the specific services included in the physical are considered qualified medical expenses under IRS regulations. For instance, certain additional tests or screenings might not be eligible for HSA reimbursement.

- Tax Advantages of HSAs

Contributions to HSAs are tax-deductible, offering a significant tax advantage for eligible individuals. Furthermore, withdrawals from HSAs for qualified medical expenses, including DOT physicals, are tax-free. This makes HSAs a potentially valuable tool for managing healthcare costs, including the expenses associated with maintaining compliance with DOT medical certification requirements. The tax benefits can significantly reduce the overall out-of-pocket cost for drivers.

- HSA Rollover and Portability

Unlike Flexible Spending Accounts (FSAs), HSA funds roll over from year to year, allowing individuals to accumulate savings for future medical expenses. Additionally, HSAs are portable, meaning individuals retain ownership of their HSA even if they change employers or health insurance plans. This portability provides flexibility and long-term financial control over healthcare spending, including DOT physicals throughout a driver’s career.

Utilizing HSAs to cover DOT physical costs provides a strategic approach to managing healthcare expenses while ensuring compliance with federal regulations. However, careful consideration of eligibility requirements and qualified expenses is crucial for maximizing the benefits of HSAs. For drivers eligible to contribute to an HSA, this approach offers a tax-advantaged way to navigate the financial aspects of maintaining medical certification for commercial driving.

4. Medicare/Medicaid Coverage

Medicare and Medicaid’s roles in covering DOT physicals are distinct and generally limited. While these programs provide essential healthcare coverage to millions, their applicability to these specific occupational health examinations is restricted due to the programs’ primary focus on general health and well-being, rather than occupational requirements. This distinction stems from the fundamental purpose of DOT physicals: ensuring fitness for duty in a specific profession, a scope outside the typical purview of these government-funded programs.

Medicare: Medicare, designed primarily for individuals aged 65 and older and certain younger individuals with disabilities, typically does not cover DOT physicals. This exclusion stems from Medicare’s focus on general healthcare needs rather than occupational health requirements. The rationale is that DOT physicals serve a specific employment purpose, not a general health purpose. For example, a retired individual receiving Medicare benefits who wishes to return to commercial driving would likely need to cover the cost of the DOT physical independently, as it falls outside Medicare’s defined coverage scope.

Medicaid: Medicaid, a joint federal and state program providing healthcare coverage to low-income individuals and families, also generally excludes DOT physicals from its coverage. While Medicaid covers a broader range of services than Medicare, its focus remains on general healthcare needs. The rationale for excluding DOT physicals is similar to that of Medicare: these examinations address occupational requirements, not general health conditions. For instance, a Medicaid beneficiary seeking employment as a commercial driver would likely need to find alternative means to cover the physical exam’s cost, as Medicaid would typically not cover this work-related requirement.

The limited coverage of DOT physicals under Medicare and Medicaid highlights the importance of exploring other avenues for financial assistance. Drivers should consider employer-sponsored health plans, personal insurance policies, health savings accounts, or negotiated rates with clinics to manage the cost of these mandatory examinations. Understanding the specific coverage limitations of these government programs allows drivers to proactively seek alternative funding sources and ensure compliance with DOT regulations without incurring undue financial burden. This awareness promotes both driver health and roadway safety by ensuring access to necessary medical evaluations without financial barriers.

5. Self-Pay Options

Self-pay options represent a crucial aspect of accessing DOT physicals, particularly when traditional insurance coverage is unavailable or insufficient. Understanding the nuances of self-pay allows drivers to navigate the financial aspects of meeting these mandatory health requirements and maintain compliance with regulations. This approach offers direct control over healthcare spending and ensures access to necessary medical evaluations, regardless of insurance coverage limitations.

- Direct Payment to Clinics

Many clinics offering DOT physicals accept direct payment from individuals. This straightforward approach allows drivers to bypass insurance complexities and pay for the examination directly. Drivers can contact clinics directly to inquire about pricing and payment options, facilitating a transparent and efficient transaction. This approach is particularly relevant for owner-operators or drivers whose employers do not offer coverage for DOT physicals.

- Negotiated Rates and Discounts

Some clinics offer negotiated rates or discounts for self-pay patients. Inquiring about potential cost reductions can significantly lower out-of-pocket expenses. Drivers might find discounted rates by contacting multiple clinics and comparing pricing structures. Some clinics might offer special rates for cash payments or pre-booked appointments. This proactive approach to cost management can make self-pay a more financially viable option.

- Payment Plans and Financing Options

Certain clinics might offer payment plans or financing options for individuals unable to cover the full cost upfront. These arrangements can make DOT physicals more accessible by spreading payments over time. Exploring available financing options allows drivers to budget effectively and avoid financial strain. However, drivers should carefully consider the terms and conditions of any financing agreements, including interest rates and repayment schedules, to ensure responsible financial management.

- Utilizing Savings or Budgeting for Expenses

Planning and budgeting specifically for DOT physical expenses can empower drivers to manage these costs effectively. Setting aside funds regularly ensures financial preparedness for these mandatory examinations. This proactive approach avoids last-minute financial challenges and reinforces the importance of prioritizing health and compliance with regulations. This strategy provides drivers with greater control over their healthcare spending and reinforces the importance of proactive financial planning.

Self-pay options empower drivers to take direct control of their healthcare expenses related to DOT physicals. Whether used as a primary payment method or in conjunction with other coverage options, understanding the available self-pay resources ensures access to essential medical evaluations and reinforces a commitment to both driver health and roadway safety. By proactively exploring these options, drivers can navigate the financial complexities of maintaining medical certification and uphold the highest standards of professional responsibility.

6. Negotiated Rates

Negotiated rates play a significant role in managing the cost of DOT physicals, particularly when traditional insurance coverage is limited or unavailable. This cost-management strategy involves direct communication between individuals or organizations and healthcare providers to establish pricing agreements for services. The connection between negotiated rates and the question of whether DOT physicals are covered by insurance is multifaceted. When insurance coverage is absent or partial, negotiated rates become a crucial tool for controlling out-of-pocket expenses. Even when insurance covers a portion of the cost, negotiating a lower rate can reduce the remaining financial burden on the individual or organization. For example, an independent owner-operator without employer-sponsored health insurance might negotiate a discounted rate with a local clinic, making the physical more affordable. Similarly, a small trucking company with a limited health insurance budget could negotiate a lower rate per physical for its drivers, potentially reducing overall healthcare expenses.

The practical significance of understanding negotiated rates lies in its potential to improve access to essential health services. By reducing financial barriers, negotiated rates can encourage greater compliance with DOT regulations. This, in turn, contributes to improved roadway safety. Moreover, negotiating rates empowers individuals and organizations to actively manage healthcare costs, fostering greater financial responsibility and control. For instance, a drivers’ association could negotiate a discounted rate with a network of clinics, offering its members a cost-effective way to meet their medical certification requirements. This collective bargaining approach demonstrates the potential of negotiated rates to improve access to affordable healthcare within specific professional communities. Furthermore, understanding the potential for negotiated rates can encourage individuals to proactively explore cost-saving options, rather than assuming a fixed price for services.

In summary, negotiated rates serve as a valuable component within the broader context of DOT physical expenses. They provide a mechanism for managing costs, particularly when traditional insurance coverage falls short. This approach empowers individuals and organizations to take control of healthcare spending, promoting both financial responsibility and compliance with essential safety regulations. The ability to negotiate rates underscores the importance of proactive communication and informed decision-making in navigating the financial aspects of healthcare, ultimately contributing to a safer and more financially sustainable transportation industry. The potential challenges associated with negotiating rates, such as variations in clinic pricing policies and the time investment required for negotiation, should also be considered. However, the potential cost savings and increased access to essential health services often outweigh these challenges.

Frequently Asked Questions about DOT Physical Coverage

This FAQ section addresses common inquiries regarding insurance coverage for Department of Transportation (DOT) physical examinations, providing concise and informative responses.

Question 1: Do all employers cover the cost of DOT physicals for their drivers?

Employer coverage varies. Some employers offer full coverage, others partial reimbursement, while some may not offer any coverage. It’s essential to confirm coverage details with the specific employer.

Question 2: Will a personal health insurance policy always cover a DOT physical?

Coverage under personal health insurance policies is not guaranteed. Policies vary, and some may exclude or limit coverage for preventative or occupational health services like DOT physicals. Careful review of policy details is recommended.

Question 3: Can funds from a Health Savings Account (HSA) be used to pay for a DOT physical?

Generally, DOT physicals qualify as preventative care and are eligible for HSA reimbursement. However, confirming that specific services within the physical meet IRS guidelines for qualified medical expenses is advisable.

Question 4: Are DOT physicals covered by Medicare or Medicaid?

Medicare and Medicaid typically do not cover DOT physicals, as these programs primarily focus on general health needs rather than occupational health requirements.

Question 5: What options are available if neither employer nor personal insurance covers the cost of a DOT physical?

Self-pay options, including direct payment to clinics, negotiated rates, payment plans, and utilizing personal savings, are viable alternatives. Exploring negotiated rates with clinics can often reduce out-of-pocket expenses.

Question 6: Where can one find additional information regarding DOT physical requirements and medical certification?

The Federal Motor Carrier Safety Administration (FMCSA) website offers comprehensive resources and guidance regarding DOT physical regulations and medical certification standards.

Understanding the various factors impacting insurance coverage for DOT physicals is crucial for both employers and drivers. Proactive planning and communication can ensure compliance with regulations while minimizing financial burden.

For further information and detailed guidance on specific aspects of DOT medical requirements, consult the subsequent sections of this article.

Securing Health on the Road

Navigating the financial aspects of DOT physicals requires careful consideration of various factors. Coverage is not uniform and depends on factors such as employer policies, individual insurance plans, and the utilization of health savings accounts. While employer-sponsored plans often cover these exams, personal policies may vary, and government programs like Medicare and Medicaid typically do not. Self-pay options, including negotiated rates with clinics, offer alternative solutions when traditional coverage is unavailable or insufficient. Understanding these diverse options empowers commercial drivers to proactively manage healthcare costs associated with maintaining medical certification.

Prioritizing driver health and safety remains paramount in the transportation industry. Ensuring access to affordable DOT physicals is crucial for upholding these priorities. Proactive planning, open communication between employers and employees, and a thorough understanding of available resources empower drivers to meet regulatory requirements while minimizing financial strain. This commitment to driver well-being ultimately strengthens the foundation of a safe and efficient transportation system.