An application for insurance often requires a tangible document containing personal information, medical history, and specific coverage requests. This document serves as a formal record of the applicant’s request for coverage and provides the insurer with the necessary information to assess risk and determine eligibility. For instance, details like an applicant’s age, occupation, lifestyle choices, and pre-existing conditions are frequently included.

Historically, these documents were exclusively paper-based, requiring physical signatures and often involving postal mail for submission. The shift toward digital platforms has streamlined the process, but the fundamental role of this structured record remains crucial. A complete and accurate record ensures transparency and facilitates efficient processing, ultimately benefiting both the applicant and the insurance provider. It allows for a clear understanding of the terms and conditions of the policy, minimizing potential disputes and enabling quicker claim settlements.

The subsequent sections will delve deeper into the key components of these applications, exploring specific aspects like the different formats available, the implications of electronic submissions, and the legal framework governing these documents. Understanding these nuances can empower applicants to navigate the application process more effectively and secure appropriate coverage.

Tips for Completing Insurance Applications

Accuracy and completeness are paramount when completing applications for insurance. Oversights or omissions can lead to delays in processing, inaccurate quotes, or even policy denial. The following tips provide guidance for a smooth and efficient application experience.

Tip 1: Review All Sections Carefully: Ensure every question is addressed and every field is completed. Leaving sections blank can trigger follow-up inquiries, prolonging the application process.

Tip 2: Provide Accurate Medical History: Disclosing complete and accurate medical information is critical. Withholding information can invalidate a policy or lead to claim denials.

Tip 3: Be Specific and Detailed: Vague or incomplete answers can lead to misinterpretations. Provide concrete details and supporting documentation when necessary.

Tip 4: Seek Clarification When Needed: If any questions or instructions are unclear, contact the insurance provider for clarification. Misunderstandings can be easily avoided through direct communication.

Tip 5: Keep Copies of All Documents: Retain copies of the completed application and all supporting documents for personal records. This documentation can be invaluable in the event of discrepancies or future inquiries.

Tip 6: Review the Policy Carefully: Once issued, carefully review the policy to ensure it accurately reflects the requested coverage and aligns with individual needs. Address any discrepancies promptly.

Following these guidelines will ensure a comprehensive and accurate application, facilitating timely processing and minimizing potential complications. A thorough approach to completing applications benefits both the applicant and the insurer.

By adhering to these recommendations, applicants can navigate the often complex process of securing insurance coverage with greater confidence and efficiency. The final section of this article will offer additional resources and support for those seeking further assistance.

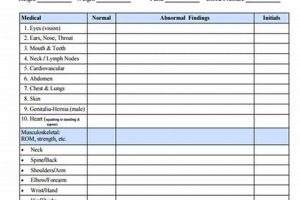

1. Applicant Information

Applicant information forms the foundation of any insurance application, including those traditionally submitted in physical format. This section establishes the individual seeking coverage and provides essential details for the insurer. The accuracy and completeness of this information directly impact the underwriting process, policy issuance, and subsequent claims processing. Incomplete or inaccurate applicant information can lead to delays, misquotes, or even policy rejections. For example, an incorrect date of birth could affect premium calculations, while an inaccurate address could hinder communication and policy delivery.

Several key data points typically comprise applicant information. These include legal name, date of birth, residential address, contact information, occupation, and social security number. This information allows the insurer to identify the applicant uniquely, assess risk factors associated with demographics and lifestyle, and verify the information provided. Furthermore, it enables efficient communication between the insurer and the applicant throughout the application process and the policy lifecycle. Providing consistent and verifiable information across all documentation is paramount for a smooth and efficient process. For instance, using different names on different documents can create confusion and delays.

In summary, accurate and comprehensive applicant information is essential for effective insurance application processing. It serves as the cornerstone for risk assessment, policy issuance, and claims management. Ensuring the meticulous completion of this section minimizes potential complications and facilitates a streamlined experience. The consequences of errors or omissions can range from minor processing delays to significant policy implications, highlighting the practical importance of accurate applicant information within the broader context of insurance applications.

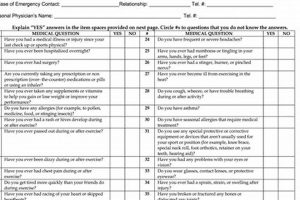

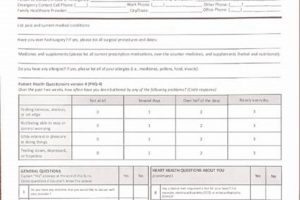

2. Medical History

Medical history constitutes a critical component of the physical application for insurance. This section provides the insurer with essential information regarding an applicant’s health status, allowing for accurate risk assessment and appropriate policy underwriting. A comprehensive medical history enables the insurer to evaluate potential risks, determine appropriate coverage, and calculate accurate premiums. Its accuracy and completeness are paramount for both the applicant and the insurer, impacting policy eligibility and future claims processing.

- Pre-existing Conditions

Disclosure of pre-existing conditions, such as diabetes, heart disease, or asthma, is essential. These conditions can significantly influence an individual’s risk profile. For example, an applicant with a history of heart disease might be considered higher risk for certain life insurance policies. Accurate disclosure allows the insurer to assess the condition’s severity and impact on potential coverage. Non-disclosure can lead to policy rescission or claim denial.

- Prior Surgeries and Hospitalizations

Details of past surgeries, hospitalizations, and related medical procedures provide further insight into an applicant’s health history. These events can indicate potential health vulnerabilities or recurring issues. For instance, multiple surgeries might suggest a higher risk for future complications. Providing accurate dates, diagnoses, and treating physicians allows for a more thorough risk assessment.

- Current Medications and Treatments

Listing current medications, ongoing treatments, and the reasons for them offers valuable information about an applicant’s present health status. Certain medications can indicate underlying health concerns or influence the likelihood of future medical needs. For example, ongoing chemotherapy treatments signal a serious health condition. This information is essential for determining appropriate coverage and premium calculations.

- Family Medical History

Family medical history, especially concerning conditions with a genetic component, can offer insights into potential future health risks. A family history of heart disease, cancer, or other hereditary conditions can elevate an individual’s risk profile. While not directly indicative of an applicant’s current health status, it contributes to a more comprehensive understanding of long-term risk factors, informing underwriting decisions.

These facets of medical history, when accurately and completely disclosed within the physical application, form the basis for a thorough risk assessment by the insurer. This process ensures appropriate policy pricing and coverage, ultimately contributing to a transparent and equitable agreement between the applicant and the insurer. Incomplete or inaccurate information can have significant consequences, potentially affecting policy validity and future claims outcomes. Therefore, a comprehensive and honest representation of medical history is crucial for a successful and mutually beneficial insurance arrangement.

3. Coverage Requested

The “Coverage Requested” section within a physical application for insurance forms a critical link between the applicant’s needs and the insurer’s offerings. This section specifies the type and extent of insurance sought, directly impacting policy terms, premiums, and potential payouts. It functions as a formal declaration of the applicant’s desired protection, outlining the specific risks for which coverage is sought. For example, within a life insurance application, this section would detail the desired death benefit amount. In a health insurance application, it would specify the desired level of coverage, such as comprehensive, basic, or catastrophic. Similarly, in property insurance, it would outline the specific property and perils for which coverage is requested, such as fire, theft, or natural disasters. The clarity and precision within this section are essential for aligning the policy with the applicant’s individual circumstances.

The information provided in the “Coverage Requested” section influences the insurer’s underwriting process. The requested coverage type and amount directly correlate with the level of risk undertaken by the insurer. A higher coverage amount typically translates to a higher risk for the insurer, potentially leading to higher premiums. For instance, a substantial life insurance policy with a high death benefit will generally command higher premiums than a smaller policy. Conversely, a health insurance policy with a high deductible and limited coverage will likely have lower premiums due to the lower risk assumed by the insurer. Therefore, a well-defined “Coverage Requested” section allows the insurer to accurately assess the risk, calculate appropriate premiums, and tailor the policy to the applicant’s specific needs and budget. Furthermore, it helps avoid potential disputes arising from misunderstandings regarding the scope of coverage.

In conclusion, the “Coverage Requested” section serves as a crucial bridge between applicant needs and insurer provisions within the physical application. Its accurate completion ensures alignment between the desired coverage and the policy issued. This understanding is vital for both applicants seeking appropriate protection and insurers aiming to manage risk effectively. Careful consideration and accurate specification within this section contribute significantly to a successful and mutually beneficial insurance agreement, minimizing potential complications and maximizing the value of the policy for all parties involved.

4. Beneficiary Designation

Beneficiary designation, a critical component within a physical application for insurance, specifies the individual or entity entitled to receive policy benefits upon the occurrence of a covered event. This designation formalizes the intended distribution of funds, ensuring that proceeds are directed according to the policyholder’s wishes. Its proper execution within the physical application is crucial for avoiding potential disputes and ensuring timely disbursement of benefits. Failure to clearly and accurately designate beneficiaries can lead to legal challenges, delays in benefit distribution, or unintended consequences regarding the allocation of assets.

- Primary Beneficiary

The primary beneficiary represents the first in line to receive policy benefits. This individual or entity is typically a spouse, child, or close relative. For example, in a life insurance policy, the primary beneficiary would receive the death benefit upon the insured’s passing. Accurate identification and contact information for the primary beneficiary are crucial for efficient claims processing.

- Contingent Beneficiary

The contingent beneficiary, or secondary beneficiary, is designated to receive benefits if the primary beneficiary is deceased, unable to be located, or declines the benefits. This designation provides a backup plan, ensuring that the benefits are distributed according to the policyholder’s intentions even if the primary beneficiary cannot receive them. For instance, if the primary beneficiary predeceases the insured, the contingent beneficiary becomes the recipient of the policy proceeds.

- Trusts as Beneficiaries

A trust can also be designated as a beneficiary. This option offers a structured approach to managing policy proceeds, particularly beneficial for complex estates or when minor children are involved. A trust provides control over how and when funds are distributed, offering flexibility and protection beyond direct beneficiary designation. This approach can safeguard assets, provide for specific needs, and ensure responsible management of the policy proceeds.

- Changing Beneficiary Designations

Policyholders retain the right to change beneficiary designations throughout the policy’s lifespan. Life events such as marriage, divorce, or the birth of a child often necessitate updates to these designations. Formal procedures for updating beneficiaries are typically outlined in the policy terms and conditions. Maintaining accurate and up-to-date beneficiary designations ensures that the benefits are directed to the intended recipients as circumstances evolve.

Accurate and comprehensive beneficiary designation within the physical application is paramount for efficient claims processing and proper distribution of benefits. These designations provide a clear roadmap for the disbursement of funds, minimizing potential conflicts and ensuring the policyholder’s intentions are honored. Understanding the different types of beneficiaries and the implications of each designation empowers policyholders to make informed decisions aligned with their individual needs and estate planning goals. Furthermore, it safeguards against unintended consequences and facilitates a smooth and timely transfer of benefits to the designated recipients.

5. Signatures

Signatures play a vital role in the legal validity and enforceability of physical insurance applications. They represent a formal acknowledgment and agreement to the terms and conditions outlined within the application. A physical application lacking the required signatures is generally considered incomplete and may not be processed. Understanding the various facets of signatures within this context is crucial for ensuring proper execution and avoiding potential complications.

- Applicant Signature

The applicant’s signature affirms the accuracy and completeness of the information provided within the application. This signature signifies the applicant’s understanding and acceptance of the terms, conditions, and declarations made within the document. For example, signing a life insurance application confirms the applicant’s agreement to the declared health status and the accuracy of personal information provided. This act of signature transforms the application from a collection of data into a legally binding agreement.

- Witness Signature

In certain cases, a witness signature may be required. The witness, an independent third party, attests to the applicant’s signature and identity. This added layer of verification strengthens the authenticity of the application and reduces the potential for fraud or misrepresentation. Witness signatures are particularly important in situations where the applicant’s capacity to sign might be questioned, such as due to illness or age.

- Agent Signature

The insurance agent’s signature, where required, confirms their involvement in the application process. This signature typically verifies that the agent has reviewed the application, answered the applicant’s questions, and fulfilled their responsibilities in facilitating the application submission. The agent’s signature serves as confirmation of their role and adherence to professional standards in the application process.

- Legal Guardians and Power of Attorney

In situations where the applicant is a minor or lacks the legal capacity to sign, the signature of a legal guardian or an individual holding power of attorney is required. This ensures that the application process adheres to legal requirements and protects the interests of the applicant. Proper documentation of guardianship or power of attorney must accompany the application in such cases.

Signatures within a physical insurance application are more than mere formalities; they are essential components that establish the legal validity and enforceability of the agreement. Each signature serves a distinct purpose, contributing to the overall integrity and binding nature of the application. Understanding the nuances of these signatures ensures proper execution, facilitates efficient processing, and reinforces the contractual agreement between the applicant and the insurer.

6. Agent Information

Agent information, a key component of many physical insurance applications, establishes a crucial link between the applicant and the insurer. This section identifies the specific agent involved in facilitating the application process, providing a point of contact for inquiries, clarifications, and ongoing support. The inclusion of agent information ensures accountability, facilitates communication, and contributes to a smoother application experience. Its presence on the physical form serves as a record of the agent’s involvement and provides a reference point for any subsequent communication or inquiries related to the application or policy.

- Agent’s Name and Contact Details

This facet provides the agent’s full legal name, business address, telephone number, and email address. This information allows the applicant and the insurer to readily contact the agent regarding any aspect of the application or policy. For example, an applicant might contact the agent to clarify specific policy provisions or to inquire about the status of their application. Accurate contact information ensures efficient communication and facilitates prompt resolution of any queries.

- Agent’s License Number

The inclusion of the agent’s license number serves as verification of their credentials and authorization to sell insurance products. This information allows for verification of the agent’s licensing status and ensures compliance with regulatory requirements. It provides a layer of transparency and accountability, safeguarding the interests of both the applicant and the insurer. For instance, an applicant can verify the agent’s license through the relevant state insurance department, confirming their legitimacy and qualifications.

- Agency Affiliation

This section identifies the specific insurance agency or brokerage the agent represents. This information clarifies the agent’s professional affiliations and provides context for their role in the application process. Knowing the agency affiliation allows for access to additional resources and support if needed. For example, if an applicant has a complaint or requires further assistance, they can contact the agency directly.

- Agent’s Signature and Date

The agent’s signature and the date of signature confirm their involvement and affirm the accuracy of the information provided within the agent information section. These elements provide a record of the agent’s participation and signify their adherence to professional standards in facilitating the application process. The date of signature helps establish a timeline for the application submission and subsequent processing.

In conclusion, agent information within the physical application for insurance serves a vital function by establishing a clear link between the applicant, the agent, and the insurer. This information facilitates communication, promotes transparency, and ensures accountability throughout the application process. The accurate and complete inclusion of agent information strengthens the integrity of the physical application, contributing to a more efficient and reliable experience for all parties involved. This information ultimately reinforces the chain of communication and accountability within the application process, safeguarding both the applicant’s and the insurer’s interests.

7. Date of Application

The “Date of Application” on an insurance application, particularly within the context of a physical form, holds significant weight, impacting policy terms, coverage effectiveness, and legal interpretations. This seemingly simple data point serves as a critical timestamp, anchoring the application within a specific timeframe and establishing a reference point for various policy-related events. Understanding the implications of the application date is crucial for both applicants and insurers.

- Policy Effective Date Determination

The application date frequently plays a role in determining the policy’s effective date. This effective date marks the commencement of coverage, the point at which the insurer assumes responsibility for covered events. The application date, in conjunction with underwriting and approval processes, establishes the timeline for coverage activation. For example, in life insurance, the effective date dictates when the death benefit becomes payable. In health insurance, it marks the start of coverage for medical expenses.

- Contestability Period Calculation

The application date is essential for calculating the contestability period, a timeframe during which the insurer can investigate the accuracy and completeness of the information provided in the application. This period typically lasts for the first two years of the policy. The application date serves as the starting point for this period, during which the insurer can potentially contest the policy’s validity if material misrepresentations or omissions are discovered. For example, if an applicant fails to disclose a pre-existing condition, the insurer might contest the policy within the contestability period.

- Premium Calculation and Age Determination

In some instances, the application date influences premium calculations, particularly in age-banded insurance products. An applicant’s age at the time of application can determine the applicable premium rate. The application date serves as evidence of the applicant’s age at the time of application, locking in the corresponding premium rate for the policy term. This is particularly relevant in life and health insurance, where age significantly impacts risk assessment and premium determination.

- Legal and Contractual Reference Point

The application date serves as a crucial reference point for legal and contractual matters related to the policy. In the event of disputes or legal proceedings, the application date can be a pivotal factor in determining the applicable policy terms and conditions. It establishes the timeframe for the agreement between the applicant and the insurer, providing a clear point of reference for interpreting contractual obligations and resolving potential conflicts.

In conclusion, the “Date of Application” on a physical insurance application is far more than a simple administrative detail. It acts as a cornerstone for numerous policy-related processes and legal considerations. Understanding its multifaceted implications is essential for both applicants seeking coverage and insurers managing risk. This date, imprinted on the physical form, establishes a critical temporal anchor, impacting policy terms, coverage effectiveness, and the overall contractual agreement between the applicant and the insurer. Its significance reinforces the importance of accurate record-keeping and attention to detail within the application process, ultimately contributing to the integrity and enforceability of the insurance contract.

Frequently Asked Questions

This section addresses common inquiries regarding paper insurance applications, providing clarity on various aspects of the process.

Question 1: What is the significance of using a physical application in the digital age?

While digital applications are increasingly prevalent, physical applications retain relevance for specific circumstances, such as situations involving complex medical histories or when individuals prefer paper-based transactions. Physical forms provide a tangible record and can be beneficial for individuals with limited digital access.

Question 2: How does one obtain a physical application for insurance?

Physical applications can typically be obtained directly from insurance providers, either through their local offices or by requesting a mailed copy. Some independent insurance agents also maintain supplies of physical application forms.

Question 3: What are the potential drawbacks of using a physical application?

Processing times for physical applications can be longer compared to digital submissions due to manual handling and postal mail. Additionally, physical forms require secure storage to protect sensitive personal information.

Question 4: Is the information required on a physical application different from a digital application?

Generally, the information required is consistent across both formats. Both physical and digital applications necessitate accurate personal information, medical history, and coverage details. The primary difference lies in the method of submission and processing.

Question 5: What steps should one take if errors are discovered on a completed physical application?

Contact the insurance provider or agent immediately to address any errors. Depending on the nature of the error, a corrected application or an amendment form might be required. Accurate information is crucial for effective policy issuance and claims processing.

Question 6: How can applicants ensure the security of their information when submitting a physical application?

Using registered or certified mail provides proof of delivery and tracking. Applicants should also retain copies of the completed application and all supporting documentation for their records. Securely storing these documents protects sensitive information.

Understanding these frequently asked questions can assist individuals in navigating the process of completing a physical insurance application and ensuring its accurate and timely processing. Thorough preparation and attention to detail are essential for securing appropriate coverage and facilitating a smooth application experience.

For further information and personalized guidance, consulting with a licensed insurance professional is recommended. They can provide tailored advice and support based on individual circumstances and insurance needs.

Conclusion

This exploration of the insurance application process, focusing on the traditional physical form, has highlighted the importance of accurate and comprehensive information. Key aspects such as applicant details, medical history, requested coverage, beneficiary designations, signatures, agent information, and the application date have been examined in detail. Each element contributes significantly to the validity and effectiveness of the application, impacting policy issuance, premium calculations, and claims processing. The enduring relevance of the physical application, even in an increasingly digital world, has been underscored, particularly for situations requiring detailed documentation or accommodating specific individual circumstances.

Careful attention to detail and thorough completion of each section within the physical application are crucial for securing appropriate insurance coverage. While digital platforms offer convenience, the fundamental principles of accurate disclosure and comprehensive documentation remain paramount, regardless of the application format. Understanding these principles empowers applicants to navigate the application process effectively, ensuring a smooth and successful outcome. A well-prepared application benefits both the applicant seeking appropriate coverage and the insurer evaluating risk. This proactive approach fosters a foundation of transparency and accuracy, essential for a mutually beneficial and enduring insurance agreement.